Financial Literacy: Fun Games For Kids!

Hit the Road – A Financial Adventure Game

For grades 5-9, a throwback to The Oregon Trail® type gameplay, NCUA’s “Hit the Road” is a fun and interactive platform for teaching young people money management skills. While on a virtual road trip across the country, you must save and spend your money wisely to complete challenges along the way.

Hit the Road | MyCreditUnion.gov. (n.d.). Www.mycreditunion.gov. Retrieved January 13, 2022, from https://www.mycreditunion.gov/financial-resources/hit-road-financial-adventure

World of Cents

Match coins to earn money, then decide how to spend it building a magical world!

World of Cents is a fun and engaging, kid-friendly game for ages 5 and up designed to help teach the value of money through the concepts of earning, saving, and spending money while incorporating basic math concepts.

World of Cents | MyCreditUnion.gov. (n.d.). Www.mycreditunion.gov. Retrieved January 13, 2022, from https://www.mycreditunion.gov/financial-resources/world-cents

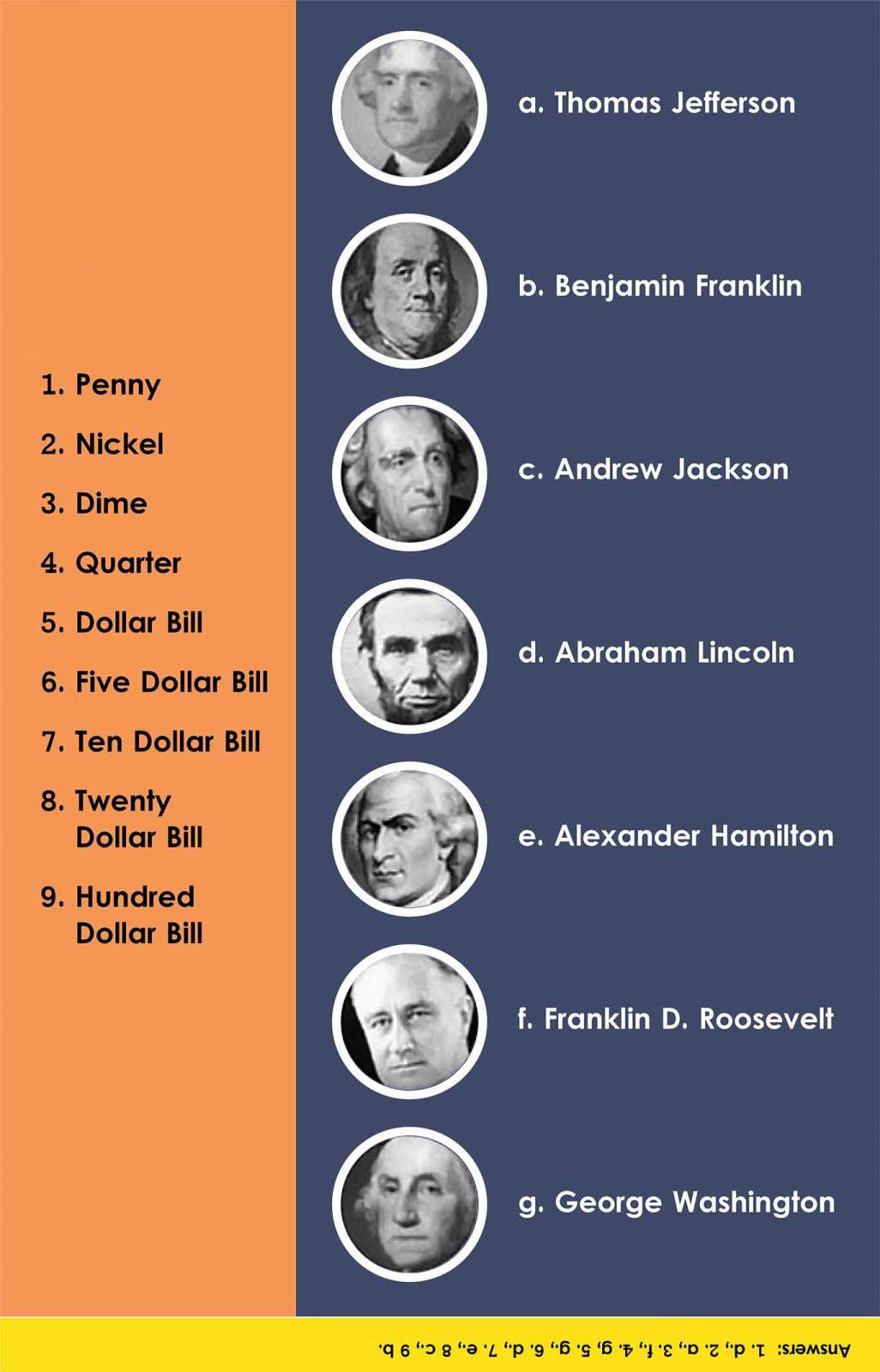

Test Your Money Memory

Test Your Money Memory is a match game that pairs United States coins and currency with the appropriate president.

Test Your Money Memory | MyCreditUnion.gov. (n.d.). Www.mycreditunion.gov. Retrieved January 13, 2022, from https://www.mycreditunion.gov/financial-resources/test-your-money-memory

Salvation Army Toy Field

Every child deserves to experience the joy of Christmas morning!

With your generous support, they can!

Each year, Enbright Credit Union sponsors a toy drive for Salvation Army’s Toy Field. The Salvation Army’s Toy Field helps children within your local communities experience the hope and joy of the holidays, giving them something to open on Christmas morning!

How Can You Help Enbright Credit Union Support Salvation Army’s Toy Field?

– Drop off your generous toy or monetary donation for a boy or girl at any of our three Enbright Credit Union Branch Locations.

– Whether you are in the lobby or drive-thru (We will send a team member out to pick up the toy if you are in the drive-thru), notify an Enbright Team Member that you would like to contribute to Salvation Army’s Toy Field.

Meet Beverly Fuqua, Enbright’s Mortgage Lending Officer

Allow me to introduce myself!

My name is Beverly Fuqua and I am a Mortgage Lending Officer in your area. I’d like to get together with you to discuss your options for purchasing or refinancing; together, I know that we can achieve a fantastic new loan that will save you money—now, and in the future!

The surge of the housing market in Nashville and surrounding areas is continuing to grow and does not look as though it will change anytime soon. That is more reason to contact me to get your pre-approval letter to have when you find that New Home.

The purchase of a new home is so much more than the accumulation of property—it is an investment in your future. You’re a hard-working individual, and you deserve to get the most out of your money—and that’s exactly what financing a new home can do for you!

Financing a home doesn’t have to be a complicated procedure if you have the right professional to guide you through the process. You have my personal guarantee that you will receive unparalleled guidance and advice throughout the entire process. I work with the best team around to also help with this process.

There are probably a lot of reasons that you have or will invest in a home: security, stability, the benefits of accruing equity—and, of course, the pride of ownership.

As your Mortgage Lending Professional, I will ensure that you are fully informed as to your best possible options, and I will advise you accordingly. You can trust that I will make every effort to make your financing process a success.

Let’s talk more about this in person; give me a call at 615-687-4801 ext. 2037 or email me at [email protected] , so that we can discuss your options. After all, it’s time for you to start investing in your future! Rates are low!!

Contact Beverly

Beverly Fuqua

Enbright Credit Union Mortgage Loan Officer

NMLS# 2135615

Enbright Credit Union

270 Indian Lake Blvd

Hendersonville, TN 37075

615-687-4801 ext 2037

Annual NES Luncheon

THANK YOU NES RETIREES FOR ATTENDING THE ANNUAL LUNCHEON!

We hope you had a fantastic time at the NES Retiree Luncheon 2021 hosted by Enbright Credit Union!

Check out all the fun highlights from this week’s event!

A Word To Our Veterans

Happy Veterans Day from Enbright!

From everyone at Enbright Credit Union: To Veterans of all branches: Thank you for your sacrifice, your bravery, and the example you set for us all! #Enbrightcreditunion #VeteransDay2021 #ThankyouArmy #ThankyouNavy #ThankyouAirforce #ThankyouMarines 🗽👏