Purchasing a Home in Tennessee? What to Know About Home Inspectors.

Wednesday, June 30, 2021 | 1:02pm

From news stories to social media, talk about Tennessee’s record-setting pace and prices for home sales seems to be everywhere. The strong interest in the Volunteer State’s housing market is proof that Tennessee has the right mix of leadership, employment and recreational opportunities when it comes to attracting prospective homebuyers.

Even as homeowners and homebuyers help bolster the Volunteer State’s economy, some consumers and real estate professionals may find themselves caught up in the breakneck pace and overlook crucial information when it comes to the role that home inspectors can play in the purchase of a home.

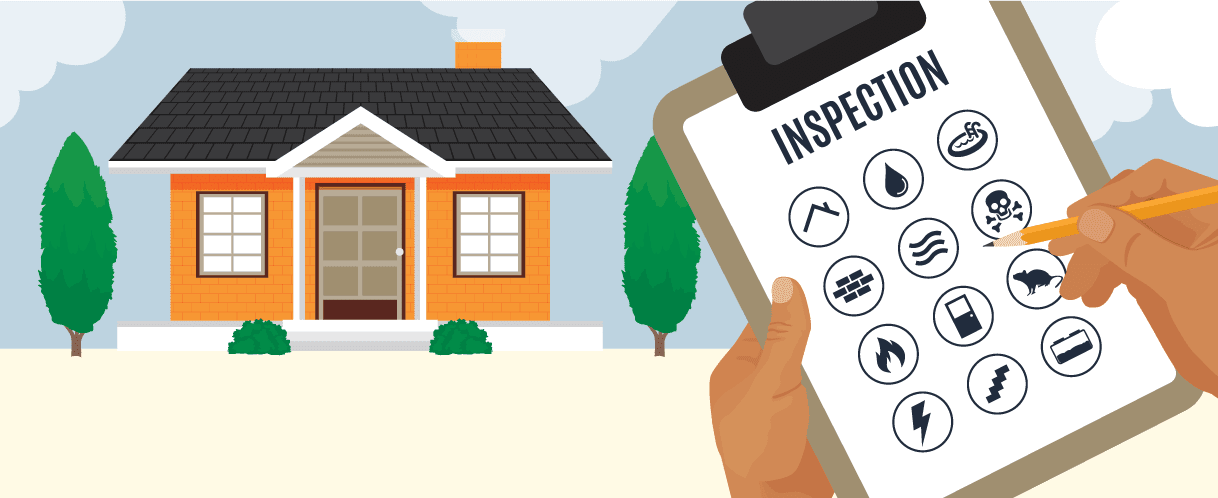

Home inspections are an educational asset that can help buyers make informed choices about the home they are considering purchasing. A licensed home inspector is an independent professional apart from the real estate agent or mortgage lender who provides a visual evaluation of the property.

The Tennessee Department of Commerce & Insurance’s (TDCI) Division of Regulatory Boards and TDCI’s Home Inspector Licensing Program want to help educate consumers when it comes to the role that Tennessee’s more than 2,000 home inspectors do and do not play when it comes to buying and selling a home.

Before hiring a home inspector, consumers should learn what a home inspector actually does during an inspection. During an inspection, a home inspector visually inspects a home’s structural components (foundation, floors, roof and walls), windows, heating and cooling systems, plumbing and electrical systems. When the inspector has completed his or her inspection, the inspector then creates a detailed report explaining the areas of the house that require repair or could potentially become problematic in the future.

Learning what a home inspection does not entail is equally important as many consumers mistakenly think home inspectors have more duties than they are actually required by law to include. Home inspectors are not required to:

- Walk a home’s roof.

- Enter a home’s crawlspace if obstructed, impassable, causes damage to the structure, or deemed to be dangerous.

- Look for mold or microorganisms though the report might note their presence, but probably need follow-up by a specialist.

- Offer or perform any act or service contrary to law.

- Offer or perform any other job function requiring a license such as engineering, architectural, plumbing or electrical work.

Another misconception that some consumers may have is that a home inspection is required by law in Tennessee before a home is sold. While a home inspection is a good idea so a buyer may have a better understanding of a home’s current condition, a home inspection is not required before the sale or purchase of a home.

Additionally, some consumers mistakenly believe a home inspection is required before getting a mortgage. That is because sometimes consumers confuse a home inspection with a home appraisal. In fact, there may be some overlap in terms of an inspection and an appraisal’s information. The home inspection is for the buyer’s benefit only. A home appraisal is required before a mortgage lender approves a mortgage.

When it comes to getting a home inspection, TDCI reminds consumers to always use a licensed home inspector. Before scheduling a home inspection, visit verify.tn.gov to check the licensing status of thousands of home inspectors and other licensed professionals regulated by TDCI. Consumers or real estate professionals with questions about home inspectors should contact TDCI’s Home Inspector Licensing Program at [email protected] or file a complaint online at core/tn.gov.

By learning about the role home inspectors play, consumers can help ease uncertainty when it comes to purchasing a home and make the process of buying a home go as smoothly as possible.

Michael Schulz serves as the Executive Director of the Tennessee Home Inspector Licensing Program at the Tennessee Department of Commerce and Insurance.

###

Opinion: Financial scams targeting older adults — especially women — are rising. Here’s what you can do

Retirement Weekly

Opinion: Financial scams targeting older adults — especially women — are rising. Here’s what you can do

Last Updated: July 9, 2021 at 11:05 a.m. ET | First Published: July 2, 2021 at 2:05 p.m. ET | By: Angie O’Leary and and Tara Ambrose

Isolation and loneliness has made things worse

NETFLIX/COURTESY EVERETT COLLECTION

Financial fraud targeting older adults has long been a problem, leading to billions of dollars of losses each year. Increased isolation and loneliness from the pandemic has further aggravated the issue.

So far in 2021, the Client Risk Prevention team at RBC Wealth Management-U.S. has seen a 40% increase in reports of scams targeting older clients year over year. What’s interesting is that 68% of the victims were female.

Anyone at any age can fall victim to a scam, but there are several factors that put older women at higher risk.

In general, women live six to eight years longer than men, according to the World Health Organization. That means as more women live to old age, more women than men are in the target demographic for elder fraud

As women outlive men, they often live alone and have no companion with whom to discuss a fraudster’s request for money. For older heterosexual couples, it’s not uncommon for men to handle most of the family finances. So in some cases, when the husband dies, women who are widowed might be taking over that responsibility for the first time, and they may be insecure about the finances. Women should especially be aware of predatory donation requests.

Living alone can also lead to loneliness, and fraudsters prey on that isolation and emotion.

Given this heightened risk, wealth managers, bankers and families should do a better job of working together to help protect not only female clients, but any older adults, from further losses and future scams.

Five common scams

The first step in protecting against these scams is making sure you can spot them. Some of the most common scams that successfully target older adults include:

- Romance scams. Initiated on dating or social media sites, scammers build a relationship for weeks or months before asking for a large sum of money. They often have a fantastic story; one of the most common story lines we’ve seen involves working on an oil rig overseas. The scammer will use the emotional and personal information they’ve gained against the victim, exploiting religious beliefs, grief and past trauma to manipulate them.

- Sweepstakes scams. These scammers claim the victim won a lottery or sweepstakes, but must pay taxes or fees to claim the prize.

- Grandma scams. A caller impersonates a relative, such as a grandchild. Calling in a panic, they say they’re in trouble and need help, and hand the phone to their “attorney” or “representative” before the victim can clearly recognize the voice. These callers insist on confidentiality, saying things like, “Don’t tell my parents,” and “You’re the only one who can help.”

- Computer software or virus scams. A pop-up ad or email says the person’s computer has been hacked and demands payment. Once the victim engages, they use extreme pressure tactics for more and more funds or gift cards.

- Government agency scams. The scammer impersonates someone from the IRS or another agency, demanding payment or a transfer of funds to avoid further penalty or jail. New scam developments

During the pandemic, scammers have gotten bolder in their attempts to target seniors. In fact, one alarming trend we’ve seen is clients being coached by scammers to lie. For example, it’s not uncommon when clients withdraw funds for the scammer, they’ll lie [to family] about what they’re using the money for because the scammers have convinced them to do so.

Additionally, scammers are now encouraging victims to move money out of investment firms to a new or local bank to avoid scrutiny. They’re coached to provide a rationale for moving the money that sounds legitimate, but they almost always come back for more. So large, unplanned withdrawals that are close together are a common indicator that something isn’t right.

Also, when victims figure out the scam and confront the caller, telling them to stop calling, the scam is not necessarily over. Recently, perpetrators have begun contacting their victims a few days after the confrontation, impersonating a government agency or a lawyer, offering to help them get their money back for a fee or help them secure the rest of their assets at a price. It might be a different person, but they are likely working with the original scammer.

How older adults can protect their finances

Though women may be more at risk, it’s important for any older adult and their families to be vigilant about protecting their finances as fraudsters become increasingly sophisticated. Because scams are only successful when the victim actually participates and hands over money, there’s usually no way to recover any of the funds.

For that reason, awareness is the first step. Be aware that there are people who impersonate government agencies, grandchildren and other people you trust. And never give out money or personal information over the phone. If you’re not sure about something, call a family member or your financial adviser. Steps to help protect your loved ones from financial fraud

If your loved one is active on social media or a dating site, advise them to video chat early in a new relationship. If they refuse, that should be a red flag.

Older adults and their trusted family members should also work out a plan for helping each other with finances. Even with healthy brain aging, we’re less likely to perceive that someone is tricking us as we age.

Families might want to have their loved one ask their financial institution to provide duplicate statements, one for the account holder and one for a loved one or trusted contact, someone their financial institution can follow up with if they have a concern about cognitive decline or suspect financial abuse. This allows others to help keep an eye on things.

Also consider asking your loved one’s phone provider to implement protections, such as spam blocking, that may help protect against scams. And partner with your financial institution to alert you of activity that could be fraudulent.

How to respond to a victim

If someone you love falls victim to financial fraud, your response can have a lasting impact on their mental health and well-being. Rather than shaming or blaming the victim, or sharing the details of the fraud with others without their permission, we recommend a response based on:

Empathy. Focus your concern on the victim’s well-being, not the money. Scams can leave a victim feeling powerless, hopeless and ashamed; it can be emotionally devastating.

Curiosity. Ask how the fraud started and about any early warning signs the victim may have seen or ignored. Helping the victim identify those signs can help stop them from talking to the scammer and avoid future scams.

Support. Keep trying if your loved one doesn’t confide in you initially. Try again another day, in another setting or with a different person. Rather than threatening to take away the victim’s independence, offer partnership and oversight.

Encourage your loved one to report the scam to the proper authorities. This can offer closure and help them move on with their lives.

Angie O’Leary is head of Wealth Planning at RBC Wealth Management-U. S.

Tara Ambrose is the senior manager of Vulnerable Client Initiatives at RBC Wealth Management-U.S.

RBC Wealth Management, a division of RBC Capital Markets, LLC, Member NYSE/FINRA/SIPC.

SOURCE: https://www.marketwatch.com/story/financial-scams-targeting-older-adults-especially-women-are-rising-heres-what-you-can-do-11625248184

2021 Sales Tax Holiday: Food, Food Ingredients & Prepared Food

Food, Food Ingredients & Prepared Food

During the period beginning at 12:01 am on Friday, July 30, 2021 and ending Thursday, August 5, 2021 at 11:59 pm, food, food ingredients, and prepared foods are exempt from sales tax. This includes qualified sales of prepared food by restaurants, food trucks, caterers, and grocery stores.

Sales of alcoholic beverages are not included in items exempt during this period.

Food and Food Ingredients

Food and food ingredients are defined as liquid, concentrated, solid, frozen, dried, or dehydrated substances that are sold to be ingested or chewed by humans and are consumed for their taste or nutritional value. Food and food ingredients do not include alcoholic beverages, tobacco, candy, dietary supplements, or prepared food.

Prepared Food

A food item qualifies as prepared food if it:

- Is sold in a heated state or heated by the seller,

- Contains two or more food ingredients mixed together by the seller for sale as a single item; or

- Is sold with eating utensils, such as plates, knives, forks, spoons, glasses, cups, napkins, or straws provided by the vendor.

Prepared food does not include food that is only cut, repackaged, or pasteurized by the seller, and eggs, fish, meat, poultry, and foods containing these raw animal foods requiring cooking by the consumer as recommended by the Food and Drug Administration to prevent food borne illnesses.

Introducing our newest Mobile Wallet feature!

Mobile Wallet

Enbright Credit Union has a brand new mobile wallet feature! Available for both Apple, Google and Samsung Wallet.

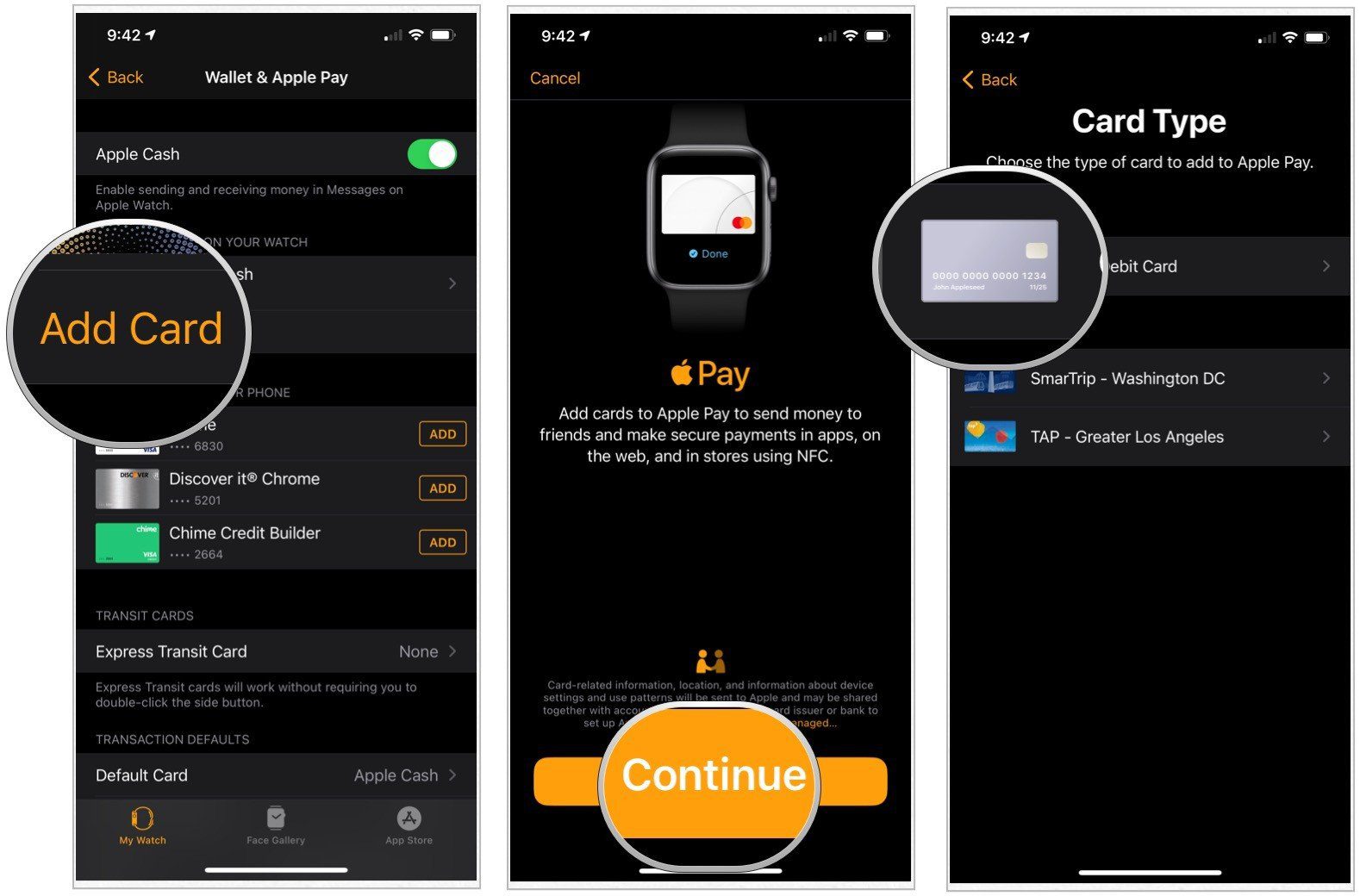

Apple Wallet

Connect your Apple iPhone, iPod touch, or Apple Watch to your Enbright Account with Apple Wallet!

Apple Wallet gives users a convenient way to organize and use rewards cards, boarding passes, tickets, gift cards, and more in one place.

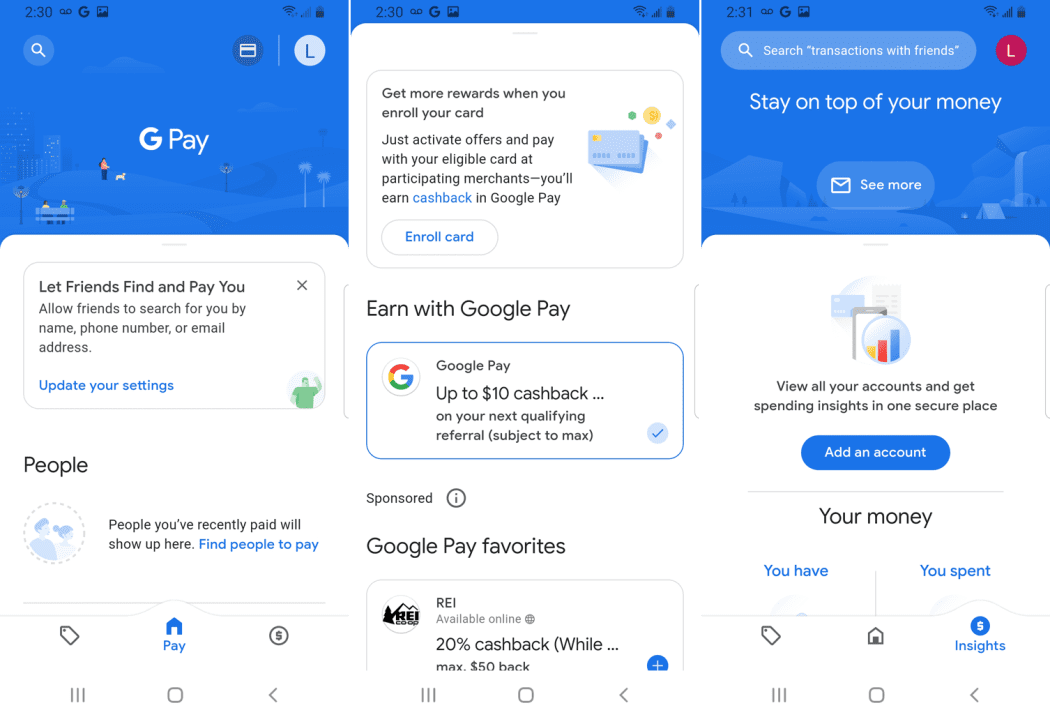

Google Wallet

Sync your Google Wallet with Enbright Credit Union!

Google Wallet is a mobile payment system that acts as a virtual wallet, allowing users to make payments and transfer money straight from their phones.

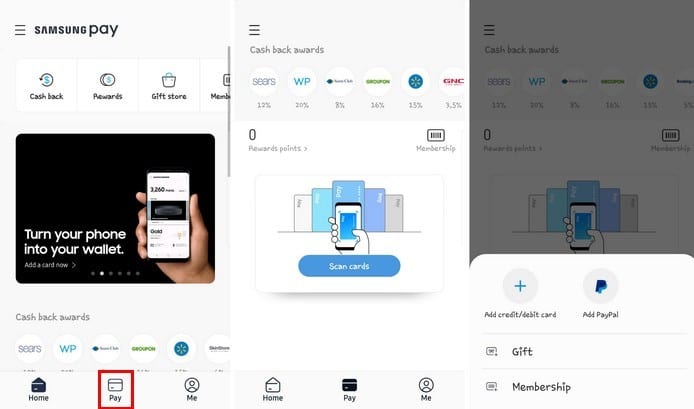

Samsung Pay

Connect with Samsung Device with Enbright Credit Union!

Samsung Pay is a mobile payment and digital wallet service by Samsung Electronics that lets users make payments using compatible phones and other Samsung-produced devices.

Follow Enbright on Social Media!

Stay Up to Date With The Latest News & Updates

Let Us Know How We're Doing

Open Your Eyes to a Credit Union®

Enbright Credit Union attended the virtual event, Tennessee Quarterly Open Your Eyes Campaign Update! This session provided valuable insights on how to best reach our potential members; education on the benefits of credit unions and overcoming the common misconceptions about member eligibility. Thank you CUNA for the insightful presentation! #EnbrightCreditUnion #CUNA #OpenYourEyes #creditunion #creditunions #credituniondifference #creditunionlife #peoplehelpingpeople #creditunionfamily #weloveourmembers #communityspirit #creditunionscare #creditunionmembers #crediteducation