Key SummaryAlthough both checking and savings accounts are essential for achieving your financial goals, they serve different purposes. The biggest difference between a checking account and a savings account is that checking accounts are typically used for everyday spending. In contrast, savings accounts are generally used for saving for long-term goals and growing your money.

Whether you’re new to banking, working on repairing your finances, or somewhere in between, you may be curious about what type of account is right for you. If you’re trying to decide between a checking account or a savings account, it’s best to understand your goal for opening a new account in the first place. And you may find that having both a checking and savings account is the best move for you.

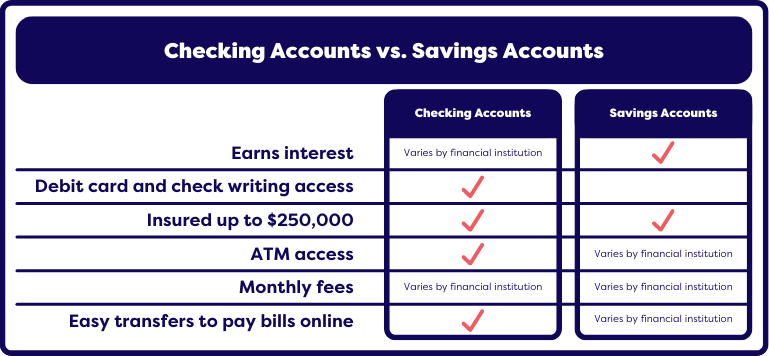

What is the Difference Between a Checking and Savings Account?

Checking accounts are better for your everyday needs, including making purchases, paying bills, and visiting ATMs. They allow you access to your money when and where you need it. Since checking accounts are designed to give you easy access to your money, they often come with debit cards, paper checks, and even offer digital payment options like Apple Pay. While checking accounts are a convenient way to access your cash, a word of caution: many banks require you to be 18 to open a checking account without a parent or legal guardian as a co-signer of the account.

Savings accounts are ideal for setting aside money for your long-term needs and goals. They are designed to hold money over a long period of time and generally accrue interest. No matter what your financial goals are, it’s ideal to have at least one savings account. When searching for a savings account, finding an account with high-interest rates should be a top priority. According to the FDIC, the average interest rate for savings accounts is 0.21% annual percentage yield. However, be on the lookout for credit union savings accounts that can boast rates above 2% APY.

Features to Look for in a Checking Account

When searching for a checking account, look for an account that doesn’t charge monthly fees and has free access to nationwide ATMs. Some top accounts can earn interest, but if they do, the rates are generally lower than what top savings accounts offer. Here are a few additional features to look for when choosing a checking account:

- No monthly fees or an easy way to waive them.

- Easy access to nationwide ATMs.

- Free debit card and access to digital payment options like Apple Pay.

- An option to order paper checks.

- Easy transfers to pay bills online.

Features to Look for in a Savings Account

When searching for a savings account, it’s best to choose one that has high-interest rates, no monthly fees and offers easy online bank transactions and transfers. Here are the features to look for when choosing a savings account:

- No monthly fees or an easy way to waive them.

- Higher interest rates than checking accounts.

- Easy online bank transactions and transfers.

Should I have both my checking account and savings account at the same financial institution?

There is no right or wrong answer when it comes to whether you should have your checking and savings accounts at the same financial institution. However, there are certainly some benefits to having both at the same bank or credit union. One benefit of having both accounts at the same financial institution is that it makes it easier to manage your money. You can also make instant transfers between the two accounts. Your bank or credit union may even waive monthly fees if you have both accounts at their institution.

However, there are some potential drawbacks to having both your checking account and savings account at the same financial institution. One downside is that you may not be maximizing the best features of both accounts. For example, some banks with the highest interest rates on savings accounts may not offer good options for a checking account.

Many credit unions offer great options for checking accounts and savings accounts. Find a credit union near you to open a new checking account or savings account (or both!).

What is the Difference Between a Checking and Savings Account? (n.d.). Default. Retrieved October 24, 2022, from https://www.yourmoneyfurther.com/blog/post/ymf/2022/10/19/what-is-the-difference-between-a-checking-and-savings-account