Annual Meeting 2023

Jun 14, 2023, 3:00 – 4:00 PM

https://meet.goto.com/604568125

Access Code: 604-568-125

United States: +1 (872) 240-3412

https://meet.goto.com/install

However, before you fill that bill-paying time bingeing a true-crime podcast, know that setting your finances on autopilot isn’t the right choice for everybody or every bill. Read on to learn the advantages and disadvantages of using automatic withdrawal to pay bills, and how you can take advantage of automatic bill payment with your local credit union.

Automatic bill pay is a money transfer from your financial institution account to the bill issuer, scheduled on a recurring date and frequency of your choosing. You can set up autopay on a variety of platforms, including banks, credit unions, credit cards, and directly with vendors.

Autopay works for nearly any type of bill. However, it’s best utilized for consistent monthly payments with little fluctuation. Most people use autopay for the following types of statements:

The automatic bill payment process is relatively simple. Once you’ve set up your autopay preferences through a vendor, bank, credit union, or credit card, your payments are automatically completed as scheduled through an ACH payment or credit charge.

ACH stands for the Automated Clearing House — an electronic funds transfer system that you likely already use. For example, if your job uses direct deposit to pay you digitally rather than with a paper check, that’s an ACH payment. Once you provide a payment source and schedule, ACH takes care of the rest through automatic money transfers.

A credit charge is run for autopay when set up through a credit card processing company. Instead of manually entering your information or swiping your card, your credit card information is stored and runs automatically on a set date.

You can easily set up automatic bill payments in person, over the phone, or online through the bill’s vendor, your financial institution, or your credit card by providing the necessary information and agreeing to a payment schedule. For example, common payment options include paying the full bill amount (statement balance in credit card speak), interest-saving balance, or a minimum or fixed amount.

Here are three ways to pay your bills automatically:

You can set up autopay directly with a vendor, like your utility company or auto lease provider, by entering your financial account and routing numbers and selecting your recurring payment date.

Many banks and credit unions have the power to manage your bill payments straight from your checking account. You can set this up by logging in to your online account and indicating who to pay, how much, and when. Some credit unions even offer automatic payment discounts when you set up automatic payments for certain bills, such as credit union loans.

Using your credit card for autopay is similar to a direct set up with a vendor. However, you will enter your credit card information rather than your bank account information. Then, the vendor will automatically run a charge on your card. From there, you will pay your credit card bill when it’s due (a bill you could also set to autopay through your bank account. Double autopay!).

While autopay is an easy way to save time, it’s important to understand that there are advantages and disadvantages of using automatic withdrawal to pay bills. For example, you’ll need to keep in mind that setting up autopay empowers these institutions to make payments on your behalf, whether you took the time to look at the bill or not.

Here are some further factors to consider:

Automatic bill payments come with many advantages to help you save time and stay on track with your financial goals. They include:

While autopay has many great features, it’s not always the right choice for everyone’s financial needs. Here are a few reasons why you may want to take a close look at whether or not you’d like to pay your bills automatically:

As we’ve learned, just because you can pay your bills automatically doesn’t mean you always should. Here are some examples of when the service can be helpful and when it’s best to shift into manual gear:

Under these scenarios, autopay will likely be beneficial to your financial goals:

Here are some scenarios when autopay may not be beneficial to your financial goals:

If you still have questions about how to pay bills automatically or how autopay can impact your financial planning, check out these websites for more autopay tips and tricks.

As you can see, there are a lot of advantages and disadvantages of using automatic withdrawal to pay bills, depending on your financial goals and needs. If you decide it’s the right option for you, automatic bill payment with a credit union can be an excellent way to declutter your financial to-do list. Use our Credit Union Locator to find a branch near you and get started.

Automatic Bill Payments What You Need to Know. (n.d.). Default. Retrieved November 1, 2022, from https://www.yourmoneyfurther.com/personal-money-solutions/banking/automatic-bill-payments-what-you-need-to-know

The Christmas Loan may be used for loan amounts up to $1,500.00 (loan amount may be less than $1500).

A member can have only one Christmas Loan Special open at a time.

APR = Annual Percentage Rate, APR based on members’ credit score.

Membership eligibility requirements apply. Other terms and conditions may apply. *All loans are subject to our normal underwriting policies and guidelines.

Institution NMLS # 418484

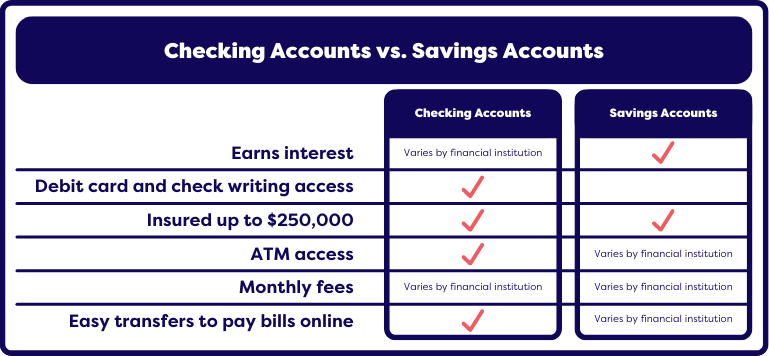

Key SummaryAlthough both checking and savings accounts are essential for achieving your financial goals, they serve different purposes. The biggest difference between a checking account and a savings account is that checking accounts are typically used for everyday spending. In contrast, savings accounts are generally used for saving for long-term goals and growing your money.

Whether you’re new to banking, working on repairing your finances, or somewhere in between, you may be curious about what type of account is right for you. If you’re trying to decide between a checking account or a savings account, it’s best to understand your goal for opening a new account in the first place. And you may find that having both a checking and savings account is the best move for you.

Checking accounts are better for your everyday needs, including making purchases, paying bills, and visiting ATMs. They allow you access to your money when and where you need it. Since checking accounts are designed to give you easy access to your money, they often come with debit cards, paper checks, and even offer digital payment options like Apple Pay. While checking accounts are a convenient way to access your cash, a word of caution: many banks require you to be 18 to open a checking account without a parent or legal guardian as a co-signer of the account.

Savings accounts are ideal for setting aside money for your long-term needs and goals. They are designed to hold money over a long period of time and generally accrue interest. No matter what your financial goals are, it’s ideal to have at least one savings account. When searching for a savings account, finding an account with high-interest rates should be a top priority. According to the FDIC, the average interest rate for savings accounts is 0.21% annual percentage yield. However, be on the lookout for credit union savings accounts that can boast rates above 2% APY.

When searching for a checking account, look for an account that doesn’t charge monthly fees and has free access to nationwide ATMs. Some top accounts can earn interest, but if they do, the rates are generally lower than what top savings accounts offer. Here are a few additional features to look for when choosing a checking account:

When searching for a savings account, it’s best to choose one that has high-interest rates, no monthly fees and offers easy online bank transactions and transfers. Here are the features to look for when choosing a savings account:

There is no right or wrong answer when it comes to whether you should have your checking and savings accounts at the same financial institution. However, there are certainly some benefits to having both at the same bank or credit union. One benefit of having both accounts at the same financial institution is that it makes it easier to manage your money. You can also make instant transfers between the two accounts. Your bank or credit union may even waive monthly fees if you have both accounts at their institution.

However, there are some potential drawbacks to having both your checking account and savings account at the same financial institution. One downside is that you may not be maximizing the best features of both accounts. For example, some banks with the highest interest rates on savings accounts may not offer good options for a checking account.

Many credit unions offer great options for checking accounts and savings accounts. Find a credit union near you to open a new checking account or savings account (or both!).

What is the Difference Between a Checking and Savings Account? (n.d.). Default. Retrieved October 24, 2022, from https://www.yourmoneyfurther.com/blog/post/ymf/2022/10/19/what-is-the-difference-between-a-checking-and-savings-account