Key Summary

At their core, credit unions are fundamentally different than other financial institutions. Because they’re not-for-profit, credit unions can focus their strategies on reinvesting in their members and communities through better rates, member dividends, alternative

loans, and community investments.

On the surface, credit unions and banks appear to be very similar. Both make loans, hold deposits, issue debit and credit cards, and offer investment services. But at their core, credit unions are fundamentally different than other financial institutions. Because they’re not-for-profit, credit unions can focus their strategies on ways to reinvest in their members and communities. Read on to learn ways credit unions invest in you and why you can and should consider joining one.

#1 Better Rates

Since credit unions aren’t out to turn a profit, they can return earnings to members in the form of higher interest rates on savings products and lower interest rates on loans and credit cards. Seth and Ashley P., members of TTCU Federal Credit Union in Tulsa, OK, experienced this first-hand. When Seth first started shopping for a new vehicle back in 2015, the credit union hadn’t even been on his radar. But when his financing with another institution fell through, the dealership helped him get a loan with TTCU for a Dodge Ram. “It had an even better interest rate than the other loan, so that worked out well.” Paula G., a member of Farmers Insurance Federal Credit Union in Burbank, CA, had a similar experience. She says, “When I got my car loan, the process could not have been easier, not to mention better rates than any bank or other lending institution.”

She’s not wrong. In fact, according to the National Credit Union Administration, an independent federal agency that insures deposits at federally insured credit unions, as of June 2020, the five-year loans for new cars at banks had an average interest rate of 4.90%, compared with just 3.28% for credit unions. The difference of 1.62% may not seem like a big deal, but it adds up over the course of your 5-year loan.

Of course, you’ll want to compare rates and services to find the best loans for you. A lot of people find that for them, that means working with a credit union.

#2 Dividends

What if I told you there was a way to have your money work for you? At a credit union, it does – through dividends.

When you deposit money into a credit union account, you become a member of the credit union. And many credit unions reward and celebrate their membership by distributing bonus dividends —surplus capital. The dividend system works because of members. Credit unions can use the base value of your deposits to fund loans, mortgages, and lines of credit to other members. As a result, the credit union pays out an annual dividend to every one of its members with an account.

Last year, Coastal Credit Union in Raleigh, NC issued more than $3.7 million in special dividends to eligible members through its Loyalty bonus program. The payout was shared among more than 69,000 members, making it Coastal’s largest bonus dividend in terms of both dollars paid and a number of recipients.

This is just another way credit unions differ from their for-profit competitors. Learn how to make your money work for you at a credit union. When shopping around for credit unions, if you want to know if they share dividends, just ask!

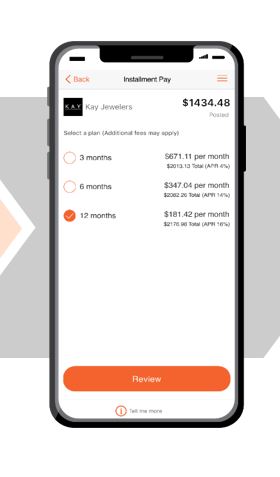

#3 Alternatives to High-Interest Loans

Life is full of these unexpected opportunities and some of those are expensive. Luckily, credit unions offer a variety of loan products to fit your needs. Whether you’re consolidating debt, covering unexpected expenses, or treating yourself to something new, a credit union can help! A Personal Loan can provide the security you need to feel confident so that you’re prepared for whatever life throws your way — and with a low rate, you’ll have more quality time to focus on what matters.

A member of Unison Credit Union in Kaukauna, WI knows this feeling all too well. As summer turned to fall and temperatures started to drop, the member noticed bubbles in her ceiling. Upon a professional’s inspection, it was clear that her roof was caving in. The damage was so severe that a new roof was needed, and that’s no small expense. With cold weather approaching, warmth and shelter compromised, and not enough money to cover a new roof, she was stressed and concerned for her family’s safety. Luckily, she was able to receive a personal loan from the credit union to cover her roof expenses.

Credit unions invest in YOU – their members. Join a credit union today.

Credit unions are unique financial institutions in that the money you deposit at your credit union stays in the local community. This money can be used to help a family get their first mortgage, finance a student’s education, or help a local business owner open a new store location. Because credit unions are not for profit, they thrive by reinvesting in their local communities.

Even though you must be a member of a credit union to receive the benefits of numbers 1 – 3, membership is not necessary to reap the benefits of the credit union’s community investment.

Brian B., a high school teacher and member of Fort Community Credit Union in Fort Atkinson, WI, is thankful for the credit union’s community involvement and investment. He explains that “team members from the credit union have been coming [into my classroom] and helping out with personal finance, marketing and accounting for about 10 years. They have been so helpful and accommodating.”

As the credit union states “Financial literacy is a passion of ours, and we want to help people learn more about it at any age. That’s why we love partnering with teachers at schools in the communities we serve to teach financial literacy to local students.” In addition, to help in the classroom, the credit union also sponsors sporting events and teams throughout the year, helping the community grow and thrive. This is just one example of the many ways credit unions invest in their communities.